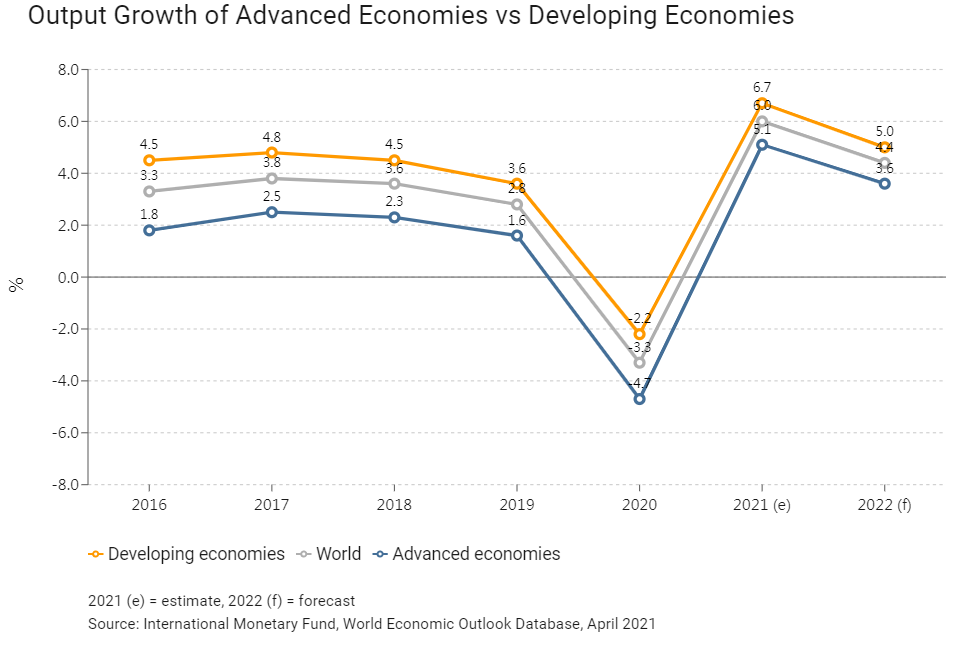

Hong Kong’s exports showed a sharp rebound of 30.8% year-on-year in the first four months of 2021, along with strong growth of 10% in global trade during 1Q21. This was largely on account of subsiding pandemic restrictions and increasingly aggressive monetary and fiscal stimuli in many of the major economies. According to the International Monetary Fund (IMF), global economic growth is projected to be 6% this year and 4.4% in 2022, while the World Trade Organization (WTO) is forecasting 8% growth in world trade volume in 2021. Given the threat of the new coronavirus variants and the shortage of vaccines in less-developed economies, however, any global economic recovery is likely to be highly uneven, with the situation also being exacerbated by tense China-US relations and other geopolitical uncertainties. With a reading of 48.7 points, the latest HKTDC Export Index has, however, indicated that exporter sentiment has continued to improve across major sectors and markets, with the figure well up on the record low of 16 points in 1Q20. As a consequence, in view of the improving sentiment and strong export performance, HKTDC Research has revised its 2021 export growth forecast to 15% from 5%, albeit from a relatively low comparison base.

More than a year on since the start of the pandemic, the economic performance of many of the major economies remains highly uneven and unsteady. While some economies are effectively reining in any new cases and, consequently, undergoing a faster economic recovery, some are still ramping up their containment measures amid a local resurgence of the pandemic. With relatively effective containment measures and massive fiscal support, Hong Kong’s real GDP resumed appreciable year-on-year growth of 7.9% in 1Q21, bringing to an end six consecutive quarters of contraction. During the same period, the mainland’s GDP picked up by 18.3%, while the US’s increased marginally by 0.4%. The GDPs of the EU and Japan, however, contracted by 1.7% and 5.1%, respectively.

Early 2021: A Solid Export Rebound

Summary of Hong Kong’s External Trade

|

2019 |

2020 |

January-April 2021 |

||||

|

HK$ mn |

Growth % |

HK$ mn |

Growth % |

HK$ mn |

Growth % |

|

| Total Exports |

3,988,685 |

-4.1 |

3,927,517 |

-1.5 |

1,492,087 |

+30.8 |

| Domestic Exports |

47,751 |

+3.1 |

47,442 |

-0.6 |

27,182 |

+100.7 |

| Re-exports |

3,940,935 |

-4.2 |

3,880,075 |

-1.5 |

1,464,905 |

+30.0 |

| Imports |

4,415,440 |

-6.5 |

4,269,752 |

-3.3 |

1,591,200 |

+25.5 |

| Total Trade |

8,404,126 |

-5.4 |

8,197,270 |

-2.5 |

3,083,287 |

+28.0 |

| Trade Balance |

-426,755 |

-342,235 |

-99,113 |

|||

| Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

On the back of the uneven recovery in the major markets and from an, admittedly, low comparison base, Hong Kong exports rebounded strongly in the first four months of 2021. The general relaxation of containment measures in many of the major economies has unleashed pent-up demand, while the resumption of production has increased the demand for raw materials and intermediate goods among the key supply chain economies. In the first four months of 2021, Hong Kong exports of final consumer products increased by 32.2% from the same period a year earlier, while exports of raw materials and semi-manufactured goods surged by 41.1%.

Overall, Hong Kong’s export performance was well in line with many of its neighbouring economies, an indication of a general rebound in supply chain activities among the major Asian nations. In specific terms, in the first four months of 2021, Hong Kong’s total export level rose by 30.8% year-on-year, while exports from mainland China increased by 44%, Japan was up 13.1%, South Korea 18.8% and Taiwan 28%, while Singapore’s non-oil exports recorded visible growth of 14.6%.

Due to rising demand in many of its key markets, Hong Kong’s exports recorded significant growth for January-April 2021. In particular, its exports to the mainland surged by 34.2%, while exports to the EU and the US also registered strong growth of 20.2% and 19.9%, respectively. Its exports to markets with strong supply chain connections, notably Taiwan and Vietnam, also recorded increases of 45.3% and 30.7%, respectively.

Hong Kong’s Total Exports by Primary Destination

|

2019 |

2020 |

January - April 2021 |

||||

|

HK$mn |

Growth % |

HK$mn |

Growth % |

HK$mn |

Growth % |

|

| US |

304,004 |

-14.8 |

258,842 |

-14.9 |

83,898 |

+19.9 |

| EU(27)(1) |

306,168 |

-7.5 |

280,207 |

-8.5 |

97,516 |

+20.2 |

| Japan |

121,012 |

-6.4 |

109,326 |

-9.7 |

35,393 |

+1.5 |

| Developing Asia |

2,862,040 |

-3.1 |

2,920,350 |

+2.0 |

1,128,982 |

+32.8 |

| Mainland China |

2,210,854 |

-3.3 |

2,324,511 |

+5.1 |

893,441 |

+34.2 |

| ASEAN |

310,732 |

+0.8 |

282,941 |

-8.9 |

103,080 |

+11.9 |

| Latin America |

79,898 |

+1.4 |

66,225 |

-17.1 |

26,590 |

+31.0 |

| Middle East |

86,581 |

+4.8 |

83,553 |

-3.5 |

31,582 |

+19.4 |

| Emerging Europe |

90,022 |

-7.6 |

92,325 |

+2.6 |

32,155 |

+20.5 |

| Africa |

42,657 |

-0.3 |

45,172 |

+5.9 |

15,850 |

+32.1 |

| Note (1): Hong Kong trade with the EU has excluded the post-Brexit UK since February 2020. | ||||||

| Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

In terms of industries, electronics exports (which account for about 70% of Hong Kong’s overall total) increased by 32.8% year-on-year in the first four months of 2021. Largely as a result of both the well-established electronics manufacturing production network within the region and strong inter-regional trade, Hong Kong’s exports of electronics to mainland China (up 37.3%), Taiwan (up 38.2%) and Vietnam (up 33.2%) all demonstrated remarkable growth in the January-April period.

Amid the general uptick, only the clothing industry’s exports dropped slightly (2.3%). The accuracy of this figure, however, may be compromised by the fact that the majority of Hong Kong garment companies have set up their production facilities offshore, mainly in mainland China or elsewhere in Southeast Asia. As offshore trade is not recorded in conventional trade figures, the export numbers as reported may not necessarily reflect the whole of the export business managed by Hong Kong companies. Indeed, as shown in the most recent HKTDC Export Index survey, sentiment among clothing exporters actually rose by 7.2 points to 43.3 in 2Q21 (from 36.1 in 1Q21). The apparent decline in Hong Kong clothing exports, therefore, may not necessarily accurately reflect the true state of the industry. Given that mainland China and Vietnam registered year-on-year increases in garment exports of 51.7% and 10.7%, respectively, in the first four months of 2021, it is entirely possible that the true picture of the Hong Kong clothing export sector is actually far rosier.

Hong Kong’s Total Exports by Selected Industry Sector

|

2019 |

2020 |

January - April 2021 |

||||

|

HK$ mn |

Growth % |

HK$ mn |

Growth % |

HK$ mn |

Growth % |

|

| Electronics |

2,725,844 |

-4.1 |

2,819,804 |

+3.4 |

1,068,843 |

+32.8 |

| Precious Jewellery |

62,867 |

+10.4 |

50,335 |

-19.9 |

22,694 |

+62.6 |

| Clothing |

96,225 |

-11.3 |

63,784 |

-33.7 |

18,263 |

-2.3 |

| Watches & Clocks |

64,223 |

-3.2 |

46,386 |

-27.8 |

17,627 |

+28.1 |

| Toys |

34,918 |

-27.4 |

29,628 |

-15.1 |

8,972 |

+42.7 |

| Household Electrical Appliances |

15,476 |

+1.9 |

13,891 |

-10.2 |

4,500 |

+15.9 |

| Source: Hong Kong Trade Statistics, HKSAR Census and Statistics Department | ||||||

Mainland China Takes the Lead

While the pandemic undoubtedly triggered a severe global recession in 2020, it is also fair to say that effective containment measures limited the extent of the economic downturn in mainland China. In fact, the mainland’s GDP rose by 2.3% in 2020, making it one of the few economies in the world to register growth. For the first four months of 2021, there has also been every sign that this upward momentum is likely to be sustained.

Looking more generally to the future, economic growth in a number of the advanced economies has begun to resume following the gradual relaxation of local lockdowns and other containment measures. Typically, business activities are slowly returning to pre-pandemic levels, with many governments providing fiscal support to designated business sectors in order to stimulate economic growth. Elsewhere, though, especially among the developing nations, economic recovery has been hindered by a resurgence of coronavirus infections and limited access to vaccines. Now, as well as the negative legacy of the pandemic, many developing economies may have to contend with the additional challenges of an overall tightening in global financial conditions and fluctuations in external demand. In April the IMF estimated the global economy would rebound by 6% in 2021, with an anticipated vaccine-driven recovery in the second half of the current year, before moderating to growth of 4.4% in 2022.

Among Hong Kong’s major export markets, mainland China was the first key economy to recover from the pandemic, a development that has become a prime driver of Hong Kong’s exports. In the first quarter of 2021, the mainland’s GDP surged by 18.3% year-on-year in real terms. At the same time, a number of other economic indicators, including industrial output, fixed investment and the Manufacturing Purchasing Mangers’ Index, also indicated the scale of the rebound. In particular, it is believed that the activities of local manufacturers have now returned to their pre-pandemic levels. In the wake of this recovery, in March mainland China announced its 14th Five-Year Plan (the Plan). Covering the period 2021-2025, it targets economic growth in excess of 6% for the current year. It also advocates a new “dual circulation” strategy aimed at supporting domestic demand and technological development. It is believed this will deliver considerable business opportunities for any Hong Kong exporter targeting the mainland market, particularly in the high-tech sector.

Looking further afield, among the developed economies, US GDP grew 0.4% year-on-year in 1Q21 but expanded by a more impressive 6.4% sequentially, its second-highest rate of growth since 2Q03. This is seen as stemming from the reopening of establishments and government assistance payments, which have boosted consumer demand and business confidence. This helped the US PMI rebound to 60.7 points in April 2021 from its pandemic-era low at 41.5 points in April 2020, while the country’s unemployment rate dropped to 6.1% in April from its record high of 14.8% a year earlier. It is now expected that consumer spending and the overall business sentiment will both continue to rise in the second half of the year.

These developments have led to many Hong Kong exporters adopting a more positive outlook towards the US market. This was reflected in the most recent HKTDC Export Index survey, which saw the positive sentiment towards the US market rise for the fourth consecutive quarter to 49 in 2Q21 (from 39.3 in 2Q20), leaving it just slightly below the neutral threshold of 50. In another positive sign, in the first four months of the year, telecommunications equipment and parts, which account for about one-fifth of Hong Kong’s total exports to the US, surged by 40.6%.

Turning to the EU, the bloc recorded a slight GDP contraction of 1.7% in 1Q21 from a year earlier. This, however, may be mitigated by the Recovery and Resilience Facility (RRF), an initiative launched in February this year with the aim of providing €672.5 billion in loans and grants to support reforms and investments undertaken by member states, as they look to make good on the economic and social damage resulting from the pandemic, while also helping to bankroll the bloc’s transition to a green and digital economy. Within its remit, the key areas for investment and reform are seen as upgrading broadband services, improving the energy efficiency of buildings, upgrading clean technology and renewable energy facilities, encouraging sustainable transportation, and boosting education / training related to digital skills. All in all, the RRF is expected to have an immediate and direct impact on the EU’s economic growth as greater demand is generated from higher public and private investment. Accordingly, Hong Kong exporters with a focus on environmental facilities and parts or components for digitalisation upgrades may find a number of new business opportunities emerging within the EU.

In the case of Japan, its economy shrank by an annualised 5.1% in 1Q21, largely on account of the fall in private consumption occasioned by the slow vaccine rollout and the rise in Covid infection levels. The country’s extended state of emergency has curbed consumer spending, which also makes the prospects for this summer’s Tokyo Olympic Games seem uncertain. Although the Suga government has already introduced three pandemic-specific packages worth a combined US$3 trillion, the vast majority of Japanese firms maintain further government spending is needed to stimulate the economy. More positively, there have been signs that manufacturing is picking up in the country, particularly in the automobile industry. This has seen the new-vehicle market continue to perform positively despite the global shortage of semiconductors. For Hong Kong exporters, there may now be opportunities related to the procurement of raw materials and semi-manufactured goods.

Economic growth within the ASEAN bloc, meanwhile, varies from member to member in line with their differing levels of success in containing their domestic coronavirus outbreaks. On the positive side, Singapore and Vietnam recorded year-on-year expansion of 1.3% and 4.5%, respectively, in 1Q21. Other economies, however, notably the Philippines, Malaysia, Indonesia and Thailand, are still hamstrung by their respective domestic caseloads.

Among the other causes for optimism is the Hong Kong-ASEAN Free Trade Agreement, which came fully into force in February this year. It is expected that this will lead to an increased flow of capital goods and components between Hong Kong and the bloc. In another development, although some manufacturers may have relocated their production and sourcing networks to ASEAN in a bid to mitigate the consequences of the China-US trade tension, among other factors, the mainland’s highly integrated supply chains may prove difficult to replace or replicate over the short term. As an international logistics and trading hub, Hong Kong has played an active role in the re-export of goods between mainland China and the ASEAN region. In fact, in the first four months of 2021, re-exports of mainland-origin goods to the bloc via Hong Kong increased by 10.2% year-on-year to HK$70 billion. Over the same period, re-exports of ASEAN-origin goods to the mainland via Hong Kong surged by 30.4% to HK$113 billion.

Key Risks: Pandemic Resurgence and Trade Protectionism

The re-emergence of Covid-19 and the potential spread of new variants are seen as the key risks for many economies, particularly in the case of less-developed nations or those with limited access to vaccines and related medical supplies. Inevitably, this will lead to continued uncertainty with regard to the global economic recovery, while also hindering the revival of global demand to a certain extent. As reported in the latest HKTDC Export Index, 41.5% of exporters see the pandemic as a primary concern in the near term, followed by weakened global demand (16.7%).

In addition, concerns relating to the global supply chain disruptions triggered by the pandemic and rising trade protectionism – most notably the prolonged China-US trade dispute – have prompted some companies to rethink their sourcing and manufacturing networks, including relocating manufacturing facilities back home or shifting their sourcing operations to other Asian countries. As the trade talks between China and the US were stalled by the pandemic following January 2020’s phase-one trade agreement, little progress has been made towards resolving the issue. There have also been concerns that even this phase-one deal has yet to be fully implemented.

Under the terms of phase one, China agreed to buy at least US$200 billion more US goods and services (relative to 2017 levels) before the end of the two-year agreement in December this year. According to estimates from the US-based Peterson Institute for International Economics, however, China’s purchase of US goods fell short by more than 40% in 2020. Furthermore, in the first four months of this year, China’s purchases of US goods represented just 60% of the year-to-date target. While it is still unclear how the two economies will manage their trade conflict, the risk to Hong Kong seems tilted more to the downside. Should mainland China purchase more products from the US, it will have only limited impact on Hong Kong’s trade, largely because mainland imports of US goods largely take the form of direct shipments. For 2020 overall, mainland China imported US$134.9 billion of goods from the US and, of that, just 7.9% (about US$10.7 billion) was routed via Hong Kong. Regardless of this, though, should China-US trade tension worsen, Hong Kong exporters may suffer on account of the deteriorating sentiment and growing uncertainty, a trend that has been evident in the past two years.

Hong Kong Exports: Strong Recovery From a Low Base

Given the improving economic outlook in the major markets and the generally more stable trading environment, we remain optimistic as to Hong Kong’s performance in the latter half of this year. Accordingly, HKTDC Research has revised its 2021 Hong Kong export performance forecast upward to 15% from 5%, while acknowledging it is from a low base. This is, potentially, the highest level of growth since 2010 when exports surged by 22.8% in the post-global financial crisis recovery period.

With regard to individual major industry sectors, electronics – which accounts for 70% of Hong Kong’s total exports – regained much of its growth momentum in the first four months of 2021. This is partly because, although many of the Covid-related lockdown and social-distancing measures have been lifted, work-from-home / e-learning arrangements have become the new normal for many office workers and students. As a result, some companies have adopted a hybrid model, allowing staff to split their work time between the home and office while, similarly, many students are now opting to take online courses after school in order to save on commuting time. The upshot of this is that demand is continuing to grow for electronics items such as computers, webcams, microphones and medical devices.

Less upbeat, however, is the outlook for the clothing sector. The continued relocation of production facilities to South and Southeast Asian countries, in tandem with depressed consumer demand, has resulted in a tough environment for Hong Kong’s clothing exporters. Regardless of this, there are a number of clear new product trends – most notably, multi-purpose and athleisure wear is on the rise as people are becoming more health conscious and keen to engage in different indoor and outdoor physical activities.

It is a very different picture with regard to Hong Kong’s toy exports, which surged by 42.7% in the first four months of 2021. Looking at this in more depth, exports of electronic and video games were up by 66%, while exports of more traditional toys and games climbed by 28%. Over the coming summer, a number of new 3D live-action and computer-animated movies are scheduled to be released, which is expected to boost demand for related digital games and peripheral toy products. In addition, the growing popularity of electronic gadgets and e-sports products / equipment is also seen as a potential driver of Hong Kong’s toy exports.

In the watches and clocks sector, although Hong Kong remains one of the world’s key exporters, in order to stay competitive, it is believed it will be necessary for the industry to move upmarket. In line with this, many of the city’s clock / watch makers are looking to develop locally designed and produced mechanical movements, while considering beginning the mass production of chronometers. At the same time, growing demand for smartwatches is seen as likely to continue to drive exports, especially as many consumers are thought to be more concerned about digitally monitoring their health in the wake of the pandemic.

Finally, turning to Hong Kong’s jewellery exports, these are also expected to pick up dramatically in line with the ongoing economic recovery. In particular, it is thought that demand for high-end jewellery items and related components – such as articles of goldsmith / silversmith ware, pearls and semi-precious stones – will rebound as consumer sentiment continues to improve. At the more affordable end of the scale, sales of stylish fashion jewellery, designer pieces and wedding / special occasion items are also expected to perform well.

Source: HKTDC