The resurgence of global economic activity gave the fashion industry worldwide a bounce as early as the second half of 2020. Following the further reopening of major fashion markets in the West, the global trade in clothing is estimated to have grown by 12% and 54% in the first and second quarter of 2021, respectively [1]. Nevertheless, logistic bottlenecks and skyrocketing shipping costs will remain as obstacles on the path to normality.

Against this backdrop, HKTDC conducted a survey at CENTRESTAGE 2021, the Asian fashion industry’s premier annual event and the first fashion event staged in Hong Kong since the pandemic began. More than 290 industry practitioners were interviewed between 10 and 12 September to take the pulse of the clothing industry and discover its business outlook for the coming year. Overall, the survey revealed that industry players have high hopes of seeing fashion back in vogue as the world economy picks up and people are out and about again spending money.

The Covid-19 Shock

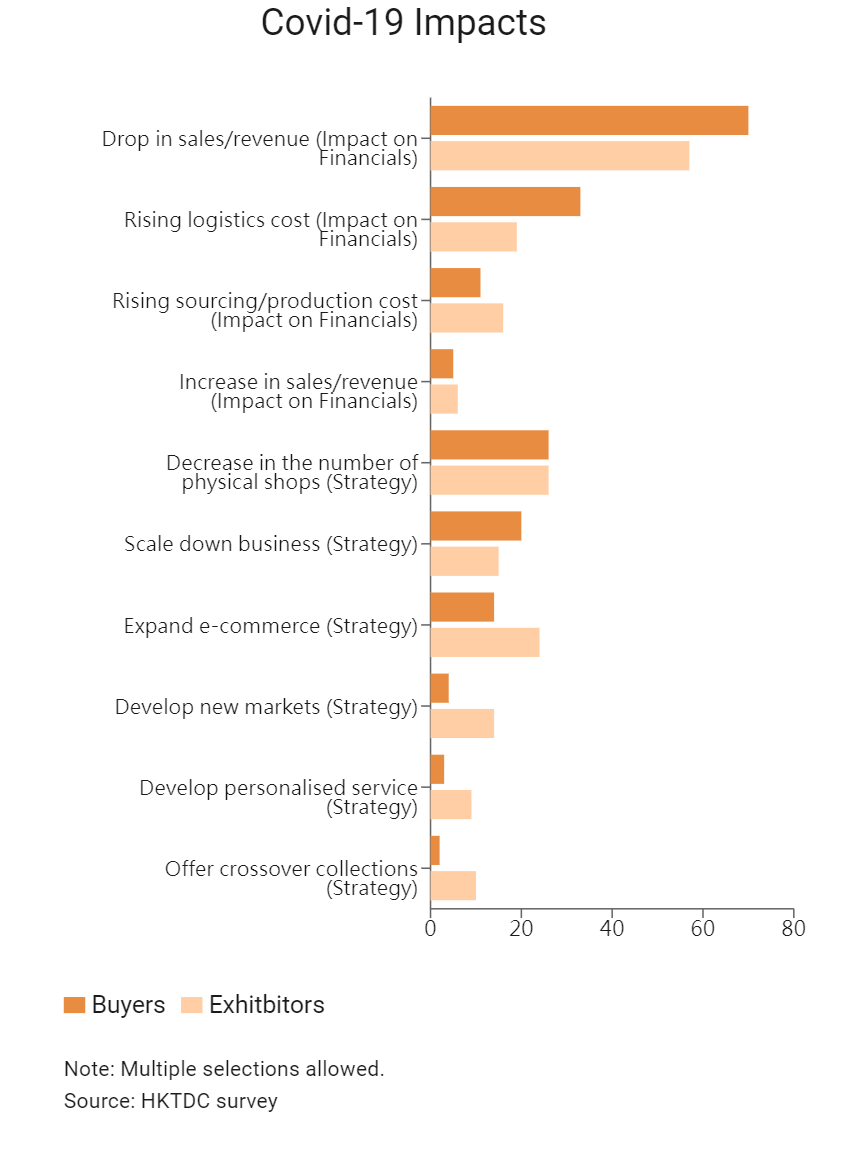

The global coronavirus pandemic has taken a heavy toll on the fashion industry, disrupting domestic and cross-border production and logistics, as well as wreaking havoc on consumer demand. According to the survey, buyers have borne the brunt of the pain. One of the major consequences of the pandemic was a plunge in sales, according to 70% of buyers, while only 57% of the exhibitors felt the same. Buyers also have greater exposure to the rising cost of logistics – the primary cost concern among traders – with one-third highlighting this pandemic-led impact on their businesses, compared to 19% of exhibitors.

The more devastating impacts on buyers’ financials are reflected in their different coping strategies. While both buyers and exhibitors have undertaken cost reduction measures such as shutting down brick-and-mortar shops (26% of buyers and exhibitors) and scaling businesses down (20% of buyers and 15% of exhibitors), buyers have been less able to increase revenue by measures such as expanding e-commerce activities (14% of buyers and 24% of exhibitors), developing new markets (4% of buyers and 14% of exhibitors), offering personalised services (3% of buyers and 9% of exhibitors) or launching crossover collections (2% of buyers and 10% of exhibitors).

A Firmer Recovery

As major markets reopened, the fashion industry started to revive as early as the second half of 2020. This encouraging trend continued in 2021, with the global trade in clothing seeing year-on-year growth of 12% and 54% in the first and second quarter [2].

Clothing exports from Hong Kong and mainland China increased in line with this. The mainland’s clothing exports performed well above the world average during the pandemic. Despite a 20% year-on-year slide in the first half of 2020, the world’s largest clothing exporter managed to close last year with just a 7% decline in clothing exports. In the first eight months of 2021, the mainland’s clothing exports exceeded those for the same period of 2019. Meanwhile, Hong Kong also registered a 4% year-on-year growth in January-August 2021.

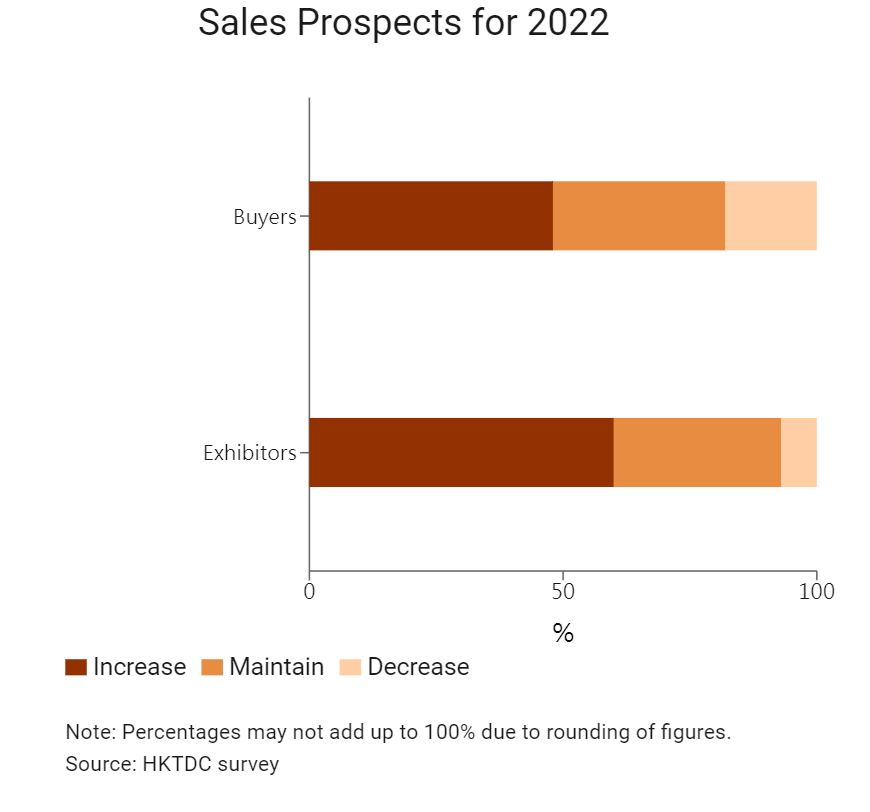

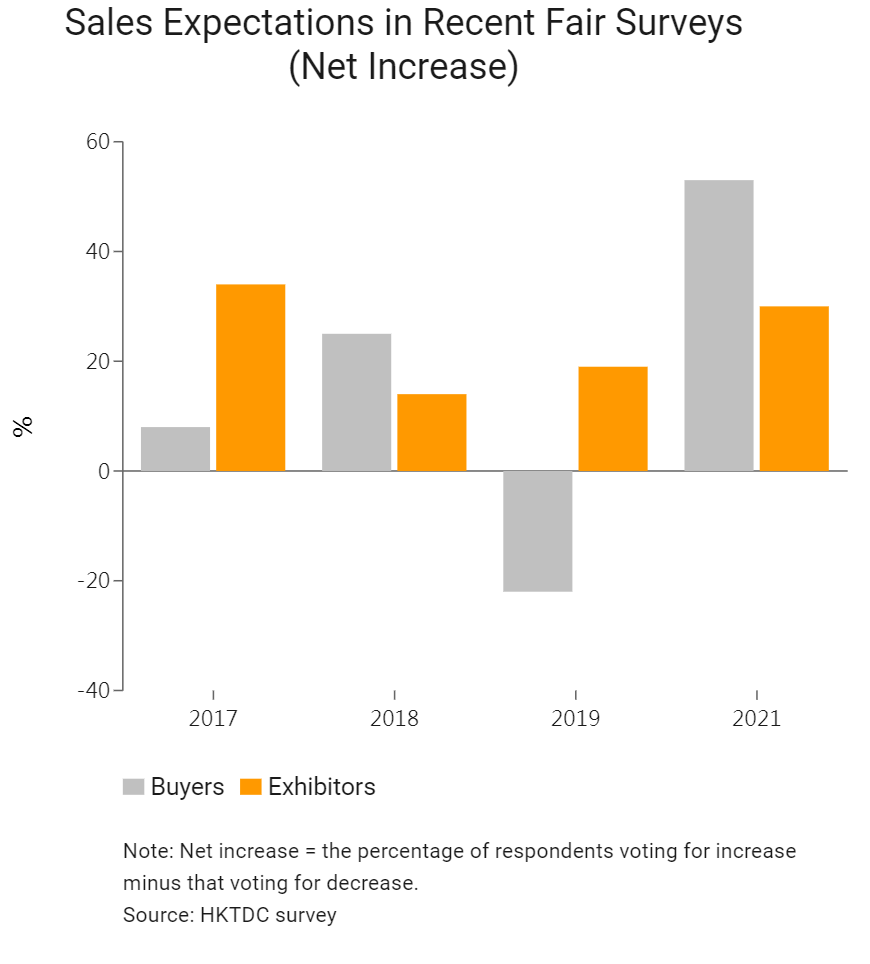

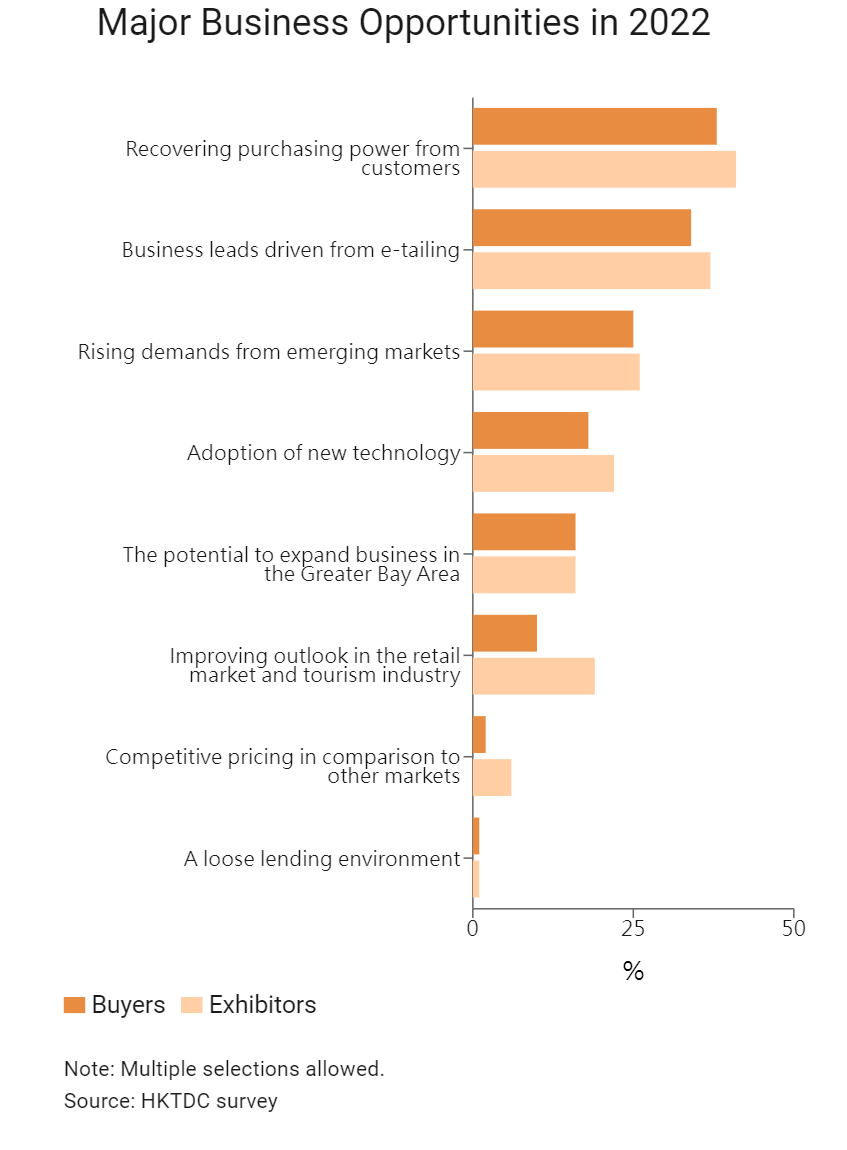

In sync with the export trade performance, fashion traders have become more optimistic about the industry outlook over the next 12 months. A net 30% (=48%-18%) of buyers and 53% (=60%-7%) of exhibitors expect sales to grow next year on the back of three top business opportunities, namely recovering purchasing power (38% of buyers and 41% of exhibitors), the rise of e-tailing (34% of buyers and 37% of exhibitors) and new promise from emerging markets (25% of buyers and 26% of exhibitors).

Production Costs, Sourcing Budgets and Retail Prices

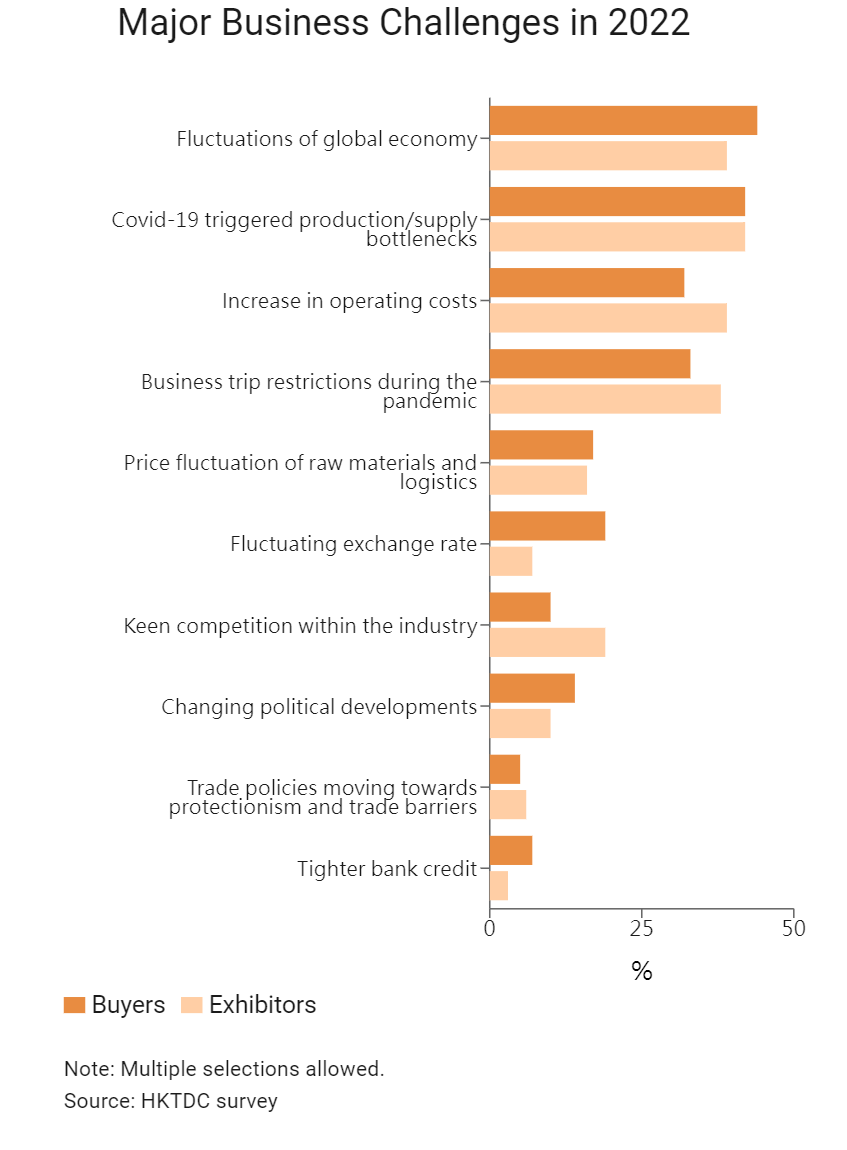

As in other industries, fashion traders see unprecedented risks looming in the global supply chains, including fluctuations in the global economy (44% of buyers and 39% of exhibitors), pandemic-triggered production/supply bottlenecks (42% of buyers and exhibitors), rising operating costs (32% of buyers and 39% of exhibitors) and restrictions on business trips (33% of buyers and 38% of exhibitors).

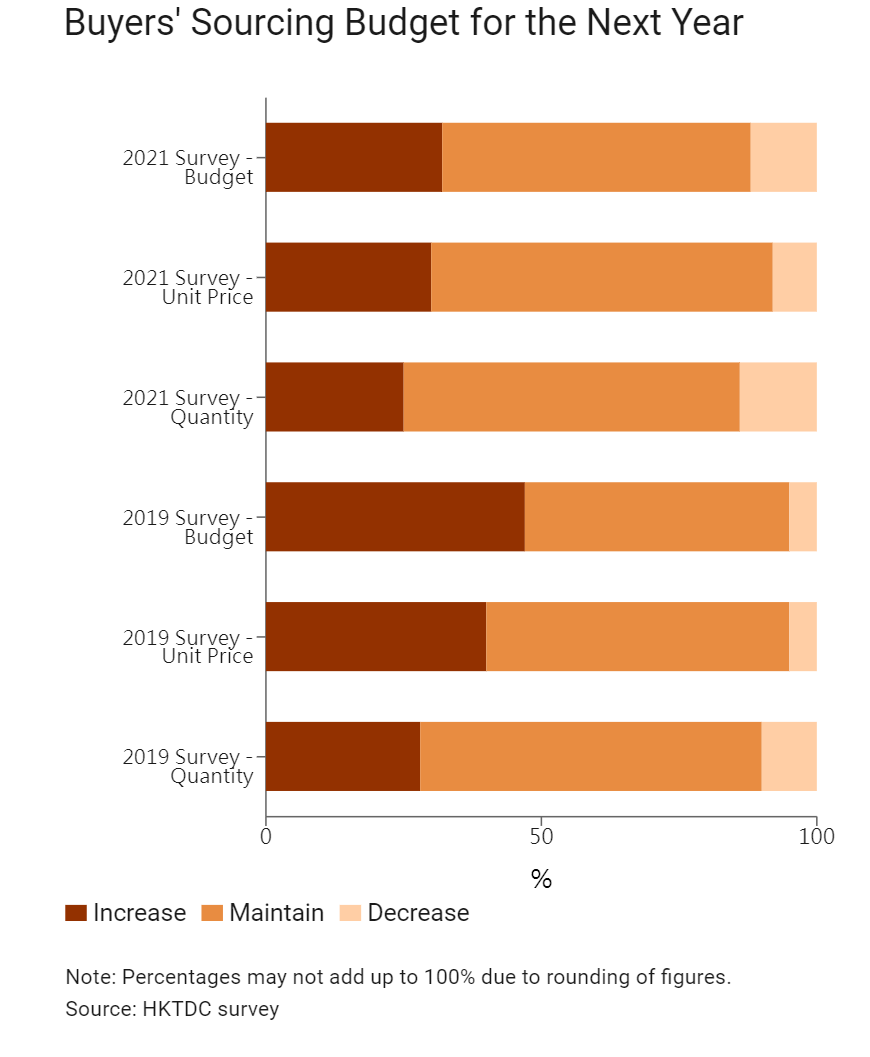

To steer the recovery past these imminent threats, buyers plan to take a more prudent approach towards their 2022 sourcing budget, with only a net 20% (=32%-12%) of buyers planning for an increase, significantly less than the 42% (47%-5%) in the 2019 survey. The weighted average growth of the sourcing budget for 2022 is 3.2%, mainly driven by the price factor.

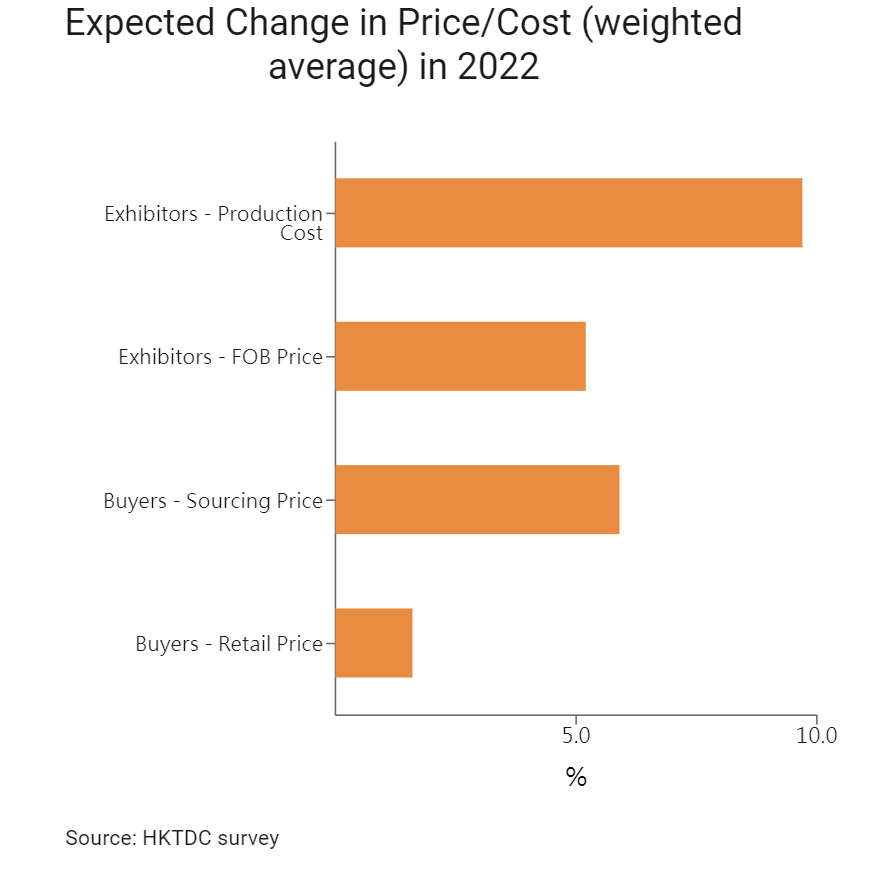

The survey also sheds light on how buyers and exhibitors are planning to handle the rising pressure on costs as supply chain disruptions continue. In anticipation of a 9.7% (weighted average) increase in production costs next year, exhibitors are willing to absorb about half of the increase, charging their buyers a 5.2% (weighted average) higher FOB price. Buyers are also ready to shoulder some of the rising costs by paying a 5.9% (weighted average) higher sourcing price, while expecting only a 1.6% increase in retail price.

Asia’s Sales Promise

How fashion traders see future sales potential in different markets and product segments is also addressed by the survey, giving an indication of their sales plans for the coming years.

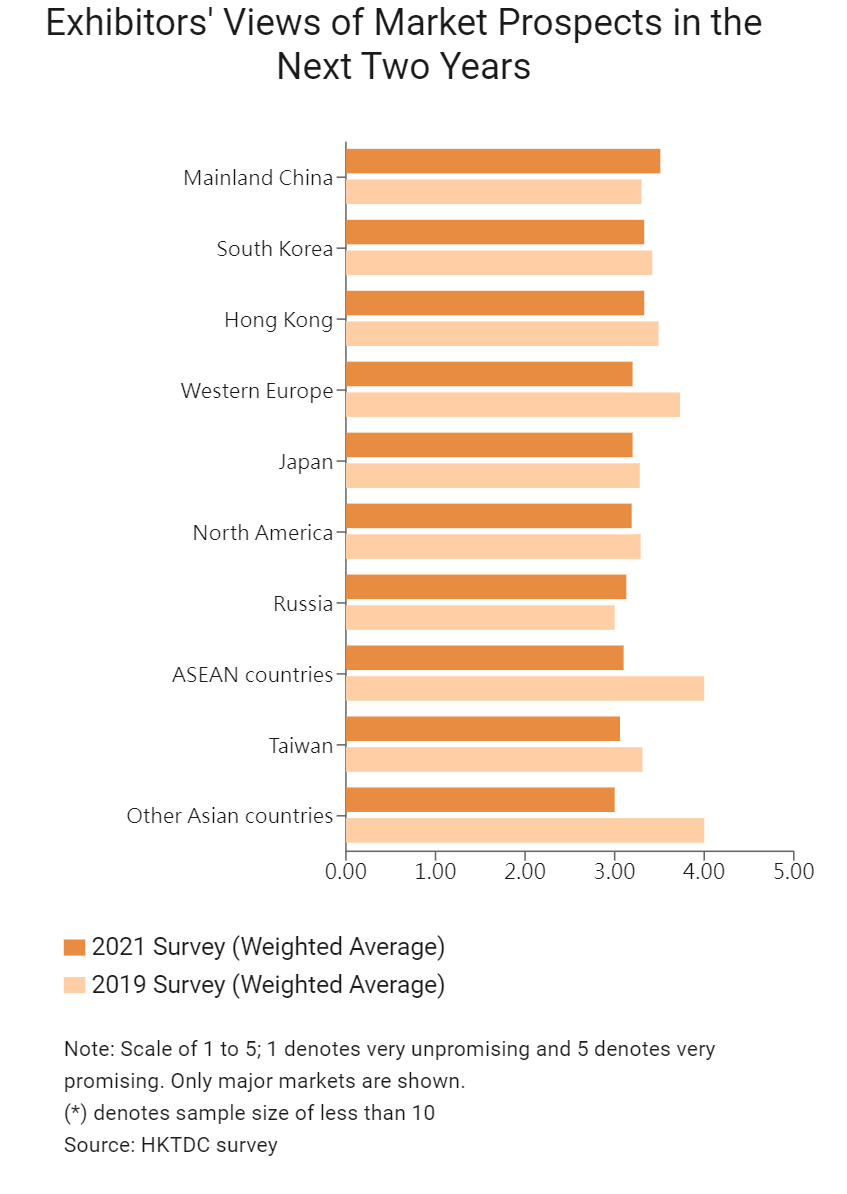

The mainland (3.51), is seen as the most promising market for the next two years, and is also one of the few markets where exhibitors see higher business potential than they did in 2019. Other Asian markets among the top five markets include South Korea (3.33), Hong Kong (3.33) and Japan (3.20). The findings are in line with the HKTDC export index 3Q21 which indicated that the best export market prospects will lie within Asia.

|

HKTDC Export Index – by Market |

|||||

|

HKTDC Export Index |

US |

EU |

Japan |

Mainland China |

ASEAN |

|

3Q21 |

44.3 |

44.1 |

47.9 |

47.8 |

44.5 |

|

2Q21 |

49.0 |

49.2 |

49.8 |

50.3 |

49.1 |

|

1Q21 |

46.1 |

42.9 |

47.3 |

48.0 |

45.2 |

|

4Q20 |

44.4 |

44.0 |

47.3 |

48.4 |

47.2 |

| Source: HKTDC Research | |||||

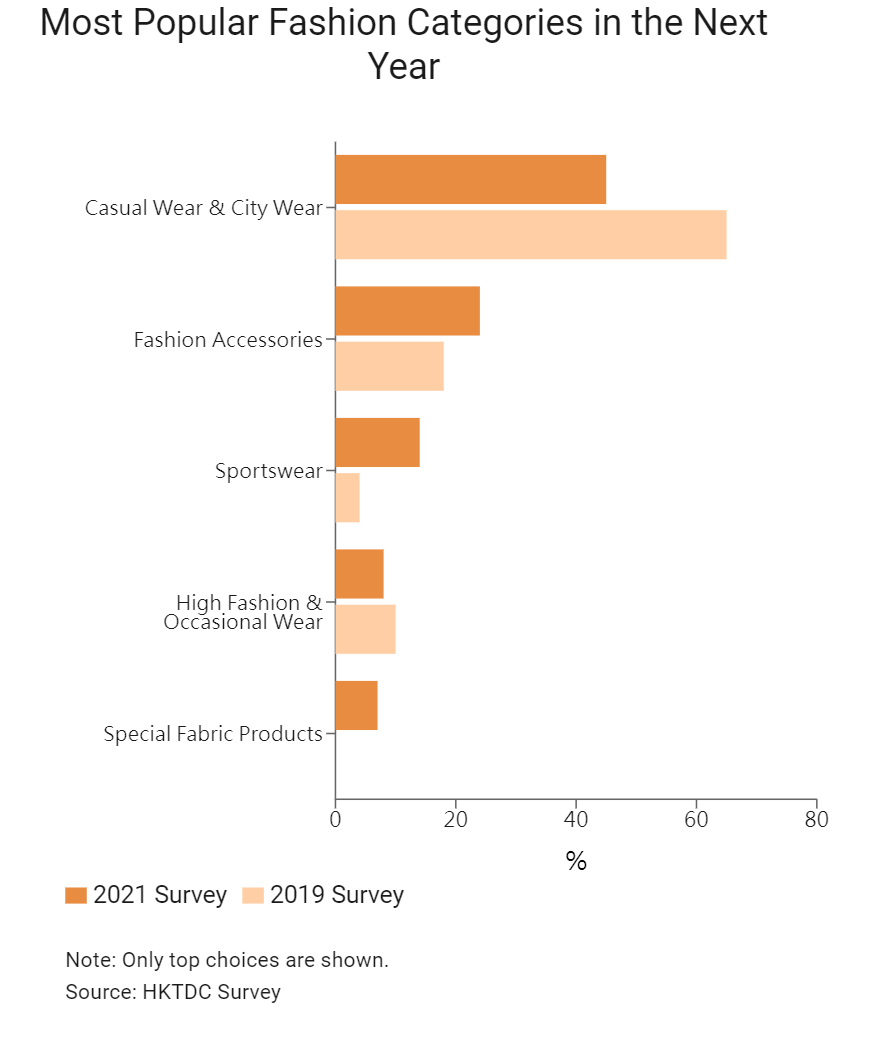

Product-wise, casual wear and city wear (45%) will remain the most popular fashion categories in 2022, despite greater interest in fashion accessories (24%) and sportswear (14%). This largely aligns with the belief that the growing popularity of sportswear and activewear such as gym and yoga clothes is likely to continue through the next year and beyond.

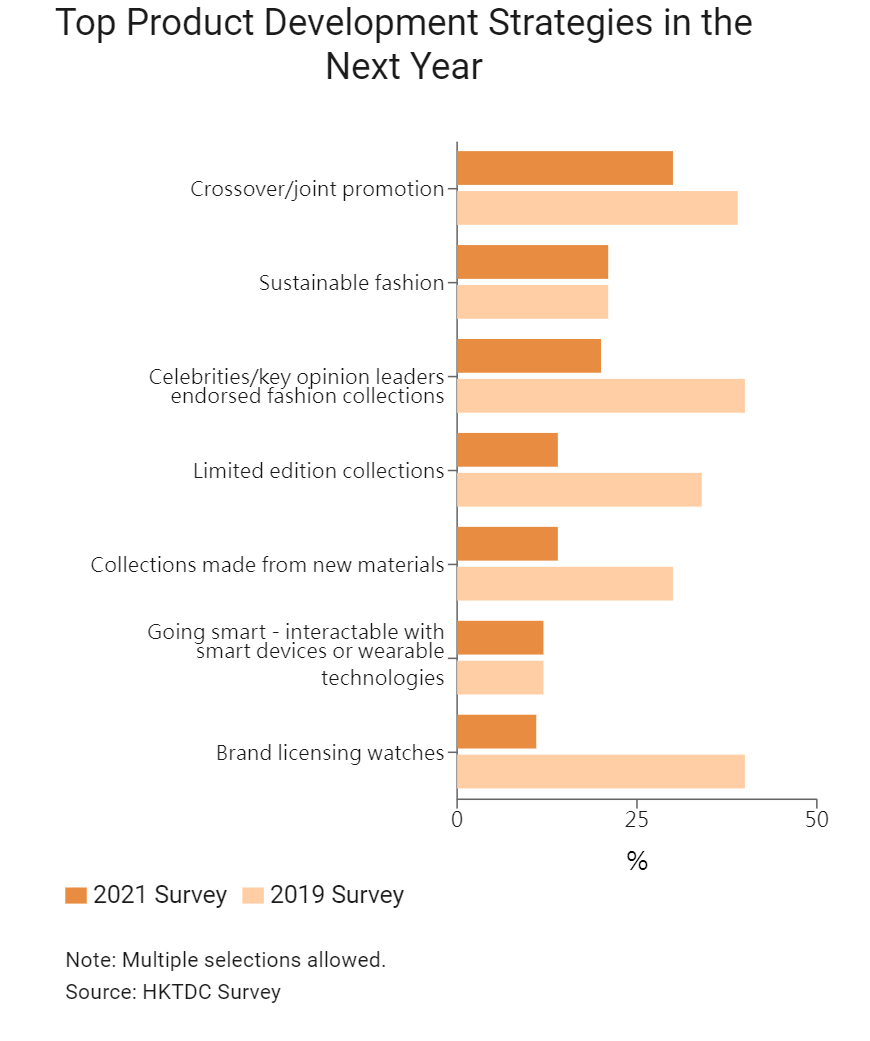

Fashion traders differ when it comes to product development. This year, crossover or joint promotion with other fashion brands has become the most popular product development strategy (30% of respondents). It is followed by sustainable fashion (21%) and celebrity or key opinion leader‑endorsed fashion collections (20%), largely in response to the rise of green consumerism and social media marketing.

E-tailing Thrives

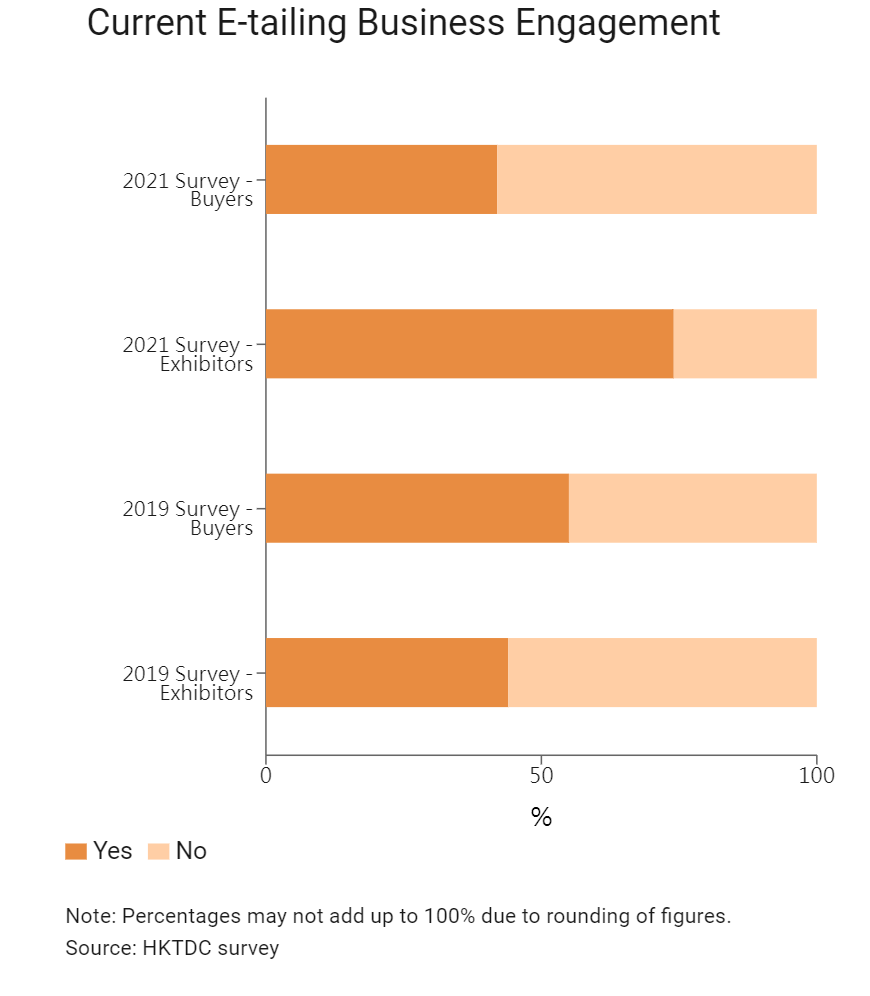

In response to the impacts of Covid-19, exhibitors have leapt to adopt e-commerce sales channels, with almost three-quarters of them having an established online presence this year, compared to just 44% in the 2019 survey. Buyers, on the contrary, had a lower e-tailing adoption rate of 42% this year, compared to 55% in 2019.

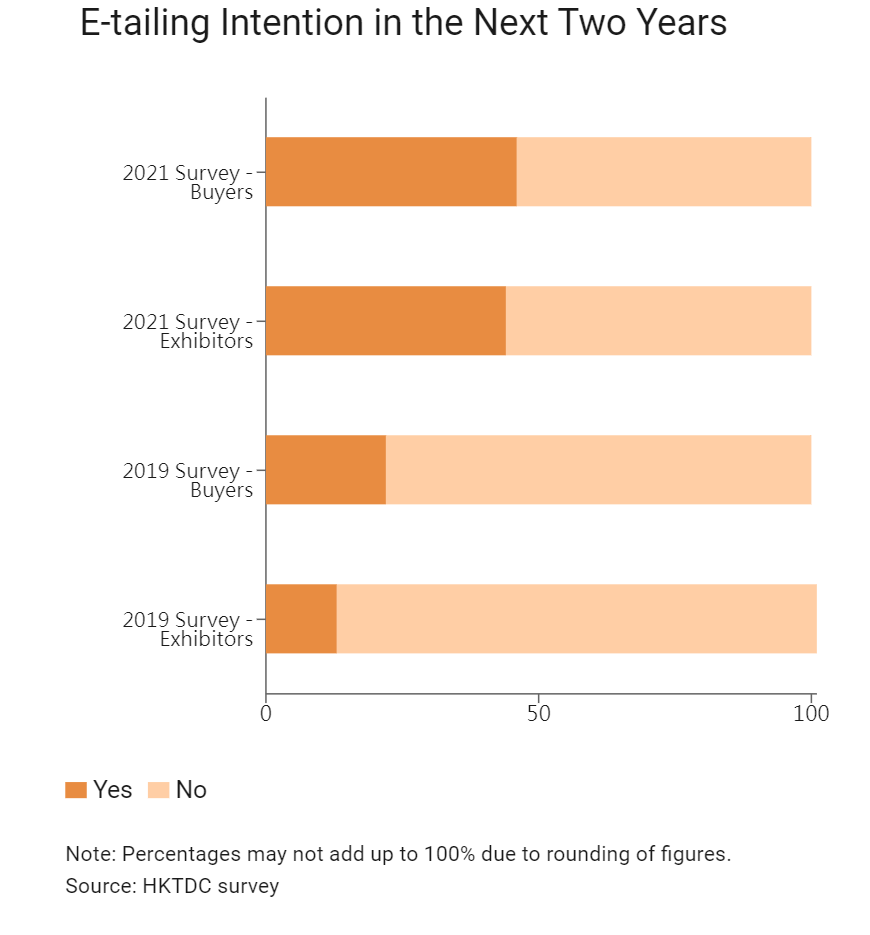

More than 40% of those who are not yet engaged in e-commerce have plans to start up in the next two years, a far greater intention than was evident in the 2019 survey.

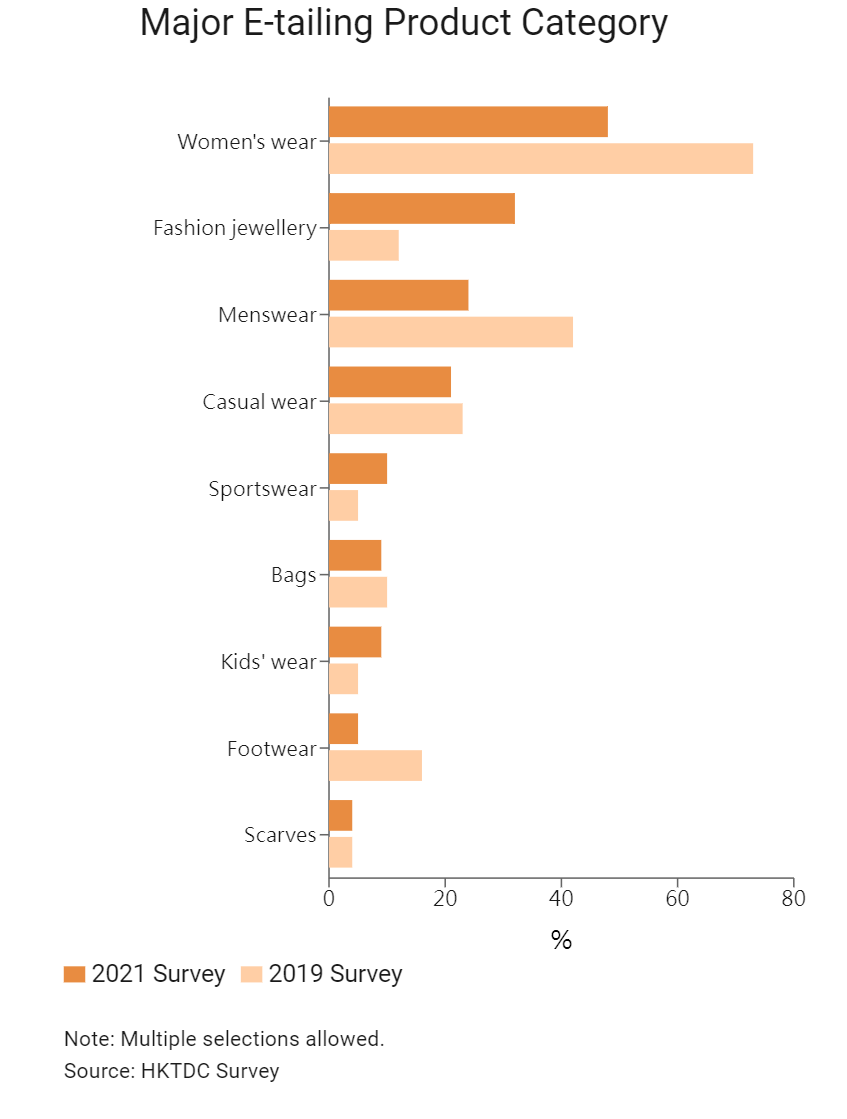

When it comes to the major fashion categories, women’s wear (48% of respondents) remains at the top of the e-tailers’ list, while men’s wear (24% of respondents) came third, after fashion jewellery – an increasingly popular product category among fashion traders (32% of respondents), moving up from fifth place in the 2019 survey.

Profile of Respondents

- 171 buyers – major markets in Europe (43%), Hong Kong (42%), North America (26%), mainland China (25%) and Asia excluding Hong Kong and mainland China (35%).

- 125 exhibitors – major markets in Hong Kong (79%), mainland China (35%), Asia excluding Hong Kong and mainland China (29%), Europe (25%) and North America (15%).

CENTRESTAGE 2021 took place from 10-12 September 2021 at the Hong Kong Convention and Exhibition Centre, which brought together more than 200 fashion brands from 24 countries and regions, with 30 fashion events taking place.

Source: HKTDC , authored by Louis Chan, Charlotte Man

[1] Global trade rebound beats expectations but marked by regional divergences, World Trade Organization (WTO), 4 October 2021

[2] Global trade rebound beats expectations but marked by regional divergences, World Trade Organization (WTO), 4 October 2021