The chancellor's policy of suspending of stamp duty on the first £500,000 of all property sales in England and Northern Ireland has helped boost house prices.

August saw the highest monthly price rise in more than 16 years, says the Nationwide. It describes the housing market recovery as "unexpectedly rapid".

So what has Chancellor Rishi Sunak done to try to help homebuyers?

What is stamp duty?

Stamp duty is a tax paid by people buying properties, although it varies slightly across the UK.

In England and Northern Ireland buyers pay Stamp Duty Land Tax.

In Scotland it is Land and Buildings Transaction Tax, while in Wales buyers pay Land Transaction Tax.

The amount handed to the government depends on where you are in the UK, and the price of the property.

The changes to stamp duty only apply to buyers in England and Northern Ireland.

- Stamp duty holiday: The winners and the losers

- House prices 'fall for first time in eight years'

- Nationwide caps mortgage lending due to virus

What has changed?

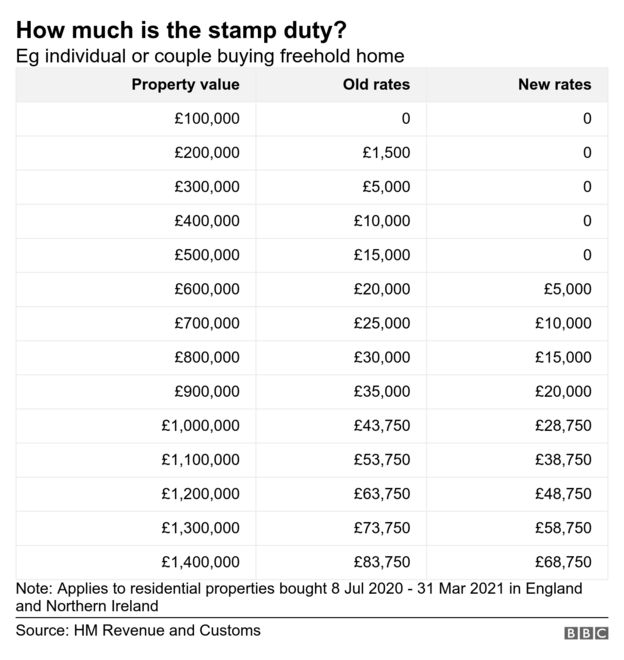

The government has temporarily increased the stamp duty threshold to £500,000 for property sales in England and Northern Ireland, until 31 March 2021.

Anyone completing on a main residence costing up to £500,000 before then will not pay any stamp duty, and more expensive properties will only be taxed on their value above that amount.

This will save buyers as much as £15,000, if they are buying a property of £500,000 or more.

The move was aimed at helping buyers who have taken a financial hit because of the coronavirus crisis.

It was also intended to boost a property market hit by lockdown, which - according to the Halifax - saw house prices fall for four months in a row.

The average stamp duty bill will drop by £4,500, Mr Sunak has suggested, with nearly nine out of 10 people buying a main home this year paying no stamp duty at all.

However, critics worry it could encourage people who were planning to buy next year to accelerate their plans to take advantage of the tax break. This could lead to a slump in demand when the tax break ends.

How much stamp duty will I pay now?

If the property purchased is your main home, you won't pay any stamp duty on it at all if it costs £500,000 or less.

The next portion of the property's price (£500,001 to £925,000) will be taxed at 5%, and the £575,000 after that (£925,001 to £1.5m) at 10%.

The remaining amount (over £1.5 million) will be taxed at 12%. You can calculate how much you are liable to pay here.

Before the announcement, stamp duty in England and Northern Ireland was paid on land or property sold for £125,000 or more, while first-time buyers did not pay any stamp duty up to £300,000. But this stamp duty holiday replaces the first-time buyer discount.

Landlords and second home buyers are also eligible for the tax cut but will still have to pay the extra 3% of stamp duty they were charged under the previous rules.

What about Scotland and Wales?

In Scotland, the rates on Land and Buildings Transaction Tax are 2% on £145,001-£250,000, 5% on £250,001-£325,000, 10% on £325,001-£750,000, and 12% on any value above £750,000.

Scottish landlords pay an extra 4% Land and Buildings Transaction Tax on top of standard rates.

In Wales, the rates on Land Transaction Tax are 3.5% on £180,001-£250,000, 5% on £250,001-£400,000, 7.5% on £400,001-£750,000, 10% on £750,001-£1.5m, and 12% on any value above £1.5m.

Welsh landlords pay an extra 3% Land Transaction Tax on top of standard rates.

How much does stamp duty raise?

The government's annual take from stamp duty is around £12bn, according to the latest figures released by HM Revenue and Customs (HMRC).

That's roughly equivalent to 2% of the Treasury's total tax take.

The nine-month stamp duty holiday in England and Northern Ireland - from July 2020 to March 2021 - will cost the Treasury an estimated £3.8bn.

https://www.bbc.com/news/business-53319433