Accounting, Tax and Corporate Services

We assist entrepreneurs and companies in their international expansion

Diacron Group, established in 1995, provides accounting, tax and corporate services. For more than 25 years, Diacron clients have relied on our dedicated consultants to suit their localized needs in the foreign markets

Our Services

Accounting Services

We support the foreign accounting division of the client by analyzing and optimizing the local processes on the basis of local regulations, potential risk areas, reference industry and through periodic company site visits. We offer accounting outsourcing services customized to the specific needs of the client

Tax Services

We offer consulting services in domestic and international taxation, assisting clients that deal with different jurisdictions, guiding them in planning and complying with their local tax requirements and in cross-border transactions

Corporate Services

We offer our own experience and competence to clients that start an internationalization project or a corporate reorganization abroad, in the establishment process, in local regulatory compliance and administrative support, leveraging our know-how and our strategic partnerships consolidated over time

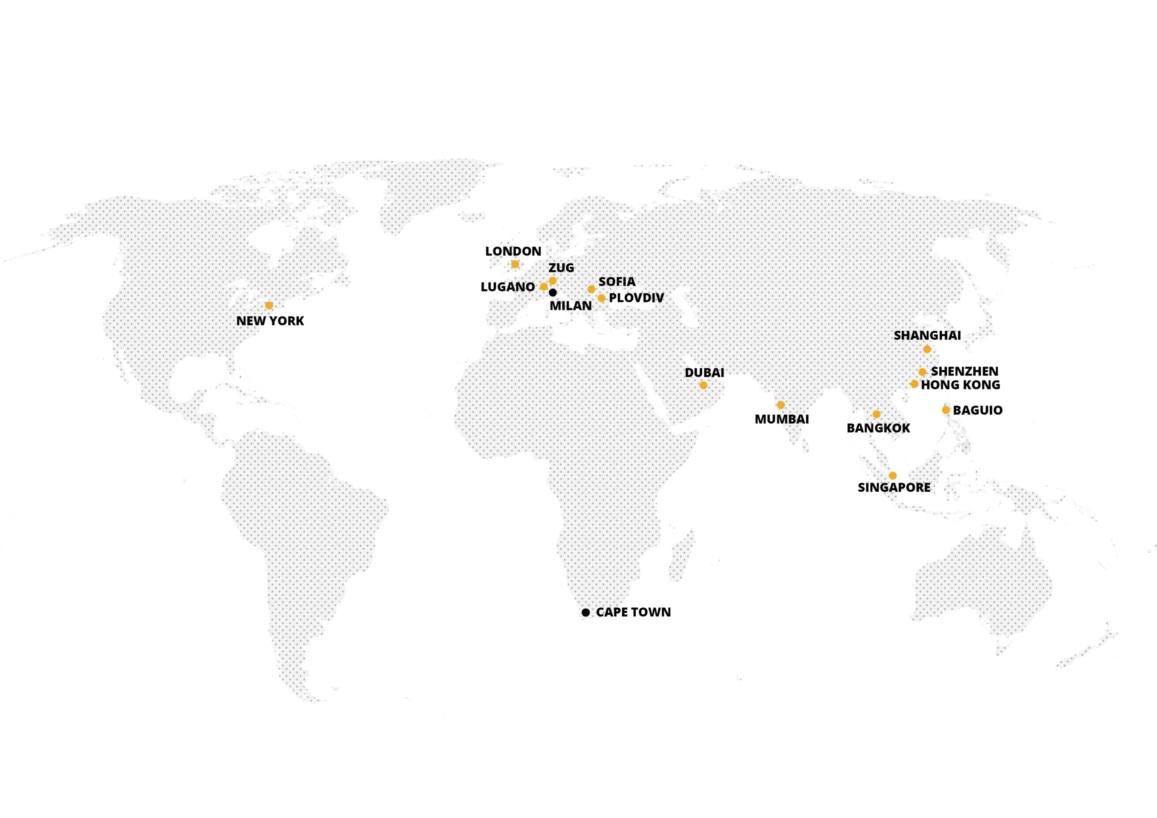

Global Presence. Local Focus

Over 800 satisfied customers in the world

Lastest Diacron news

Need more information?

Fill the form and you will be contacted in a short time by one of our consultants