The President’s Made in America Tax Plan provides a framework to raise revenues in order to rebuild our infrastructure and to make critical investments in education, research, and clean energy, all of which help the United States remain the best place in the world to do business. The plan would not just generate funding to pay for a sustained increase in investments, but it would do so in a way that makes good policy sense. Importantly, it would fix a broken international tax system that rewards corporations for offshoring jobs and shifting profits overseas.

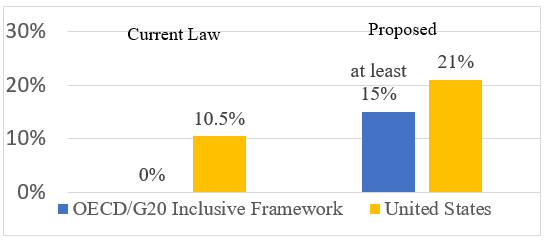

Under current law, U.S. multinational corporations face only a 10.5% minimum tax on their foreign earnings, half the rate that they pay on their domestic earnings, incentivizing them to operate and shift profits abroad. That rate is also far less than small businesses pay on Main Street - which earn all of their profits at home - or the tax rates faced by workers - who bear an increasing share of the tax burden as the corporate burden dwindles.

The Made in America Tax Plan would increase the minimum tax on corporate foreign earnings to 21%, reducing a corporation’s incentives to shift profits and jobs abroad. This policy would bring fairness to the working and middle classes not only through the programs it funds but by creating a more level playing field so that jobs and investment can flourish in the United States. Under current law, companies have large tax incentives to put activities and earnings offshore; a strong minimum tax can reduce that tax distortion, favoring activity and earnings at home.

Corporations have defended a lower rate on foreign income by arguing that their foreign competitors often pay 0% on their foreign earnings; in other words, they argue that U.S. corporations should pay less than American working people in the name of “competitiveness.” Regardless of what the U.S. corporate rate has been in recent decades, whether 35 percent (pre-2017) or 21 percent since then, U.S. corporations have been the most profitable in the world, advantaged by a large market, strong institutions, and a well-educated work force. Future investments in climate change mitigation, education, infrastructure, and research and development - funded by these tax changes – will maintain that standing and will only make the competitive position of U.S. corporations stronger.

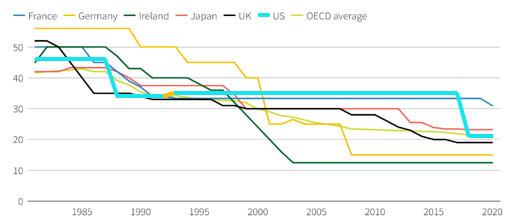

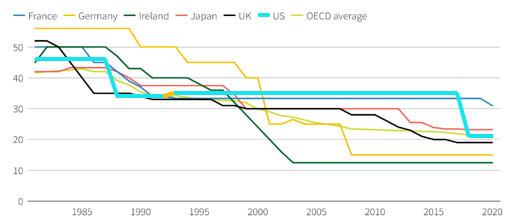

Further, in a generational achievement, 134 countries, representing more than 90% of the world’s GDP, have agreed to rewrite the international tax rules to impose a global minimum tax on corporate foreign earnings, thereby ending the race to the bottom that has starved nations of revenues. In the realm of tax competition, no country wins and working and middle class people around the world lose.

|

Global Decline in Corporate Tax Rates

|

Importantly, the global minimum tax will function as a floor, not a ceiling, and will therefore allow nations to calibrate the precise rate to their specific country’s needs. The United States must and can act boldly here, leading the way with a 21% minimum tax on the foreign earnings of U.S. corporations. With a global minimum tax now on the horizon, U.S. corporations will be more competitive than they ever were before, as foreign corporations will face minimum tax rates almost worldwide. Importantly, the agreement includes enforcement provisions that encourage countries to join by imposing unfavorable tax treatment on companies based in recalcitrant countries. And with the establishment of a level playing field, the global minimum tax deal creates reliable revenues going forward, benefitting generations to come.

|

Current Global and U.S. Minimum Rates on Corporate Foreign Earnings

|

As Congress begins to finalize its legislation, Secretary Yellen has urged its Members to remember the historic opportunity that we have to end the race to the bottom. We can have a tax code that both works for the middle class and furthers the competitiveness of U.S.-based multinationals. Embracing a strong minimum tax at 21 percent is in the national interest and will also further our international efforts toward reducing the pressures of tax competition.

Source: US Department of the Treasury