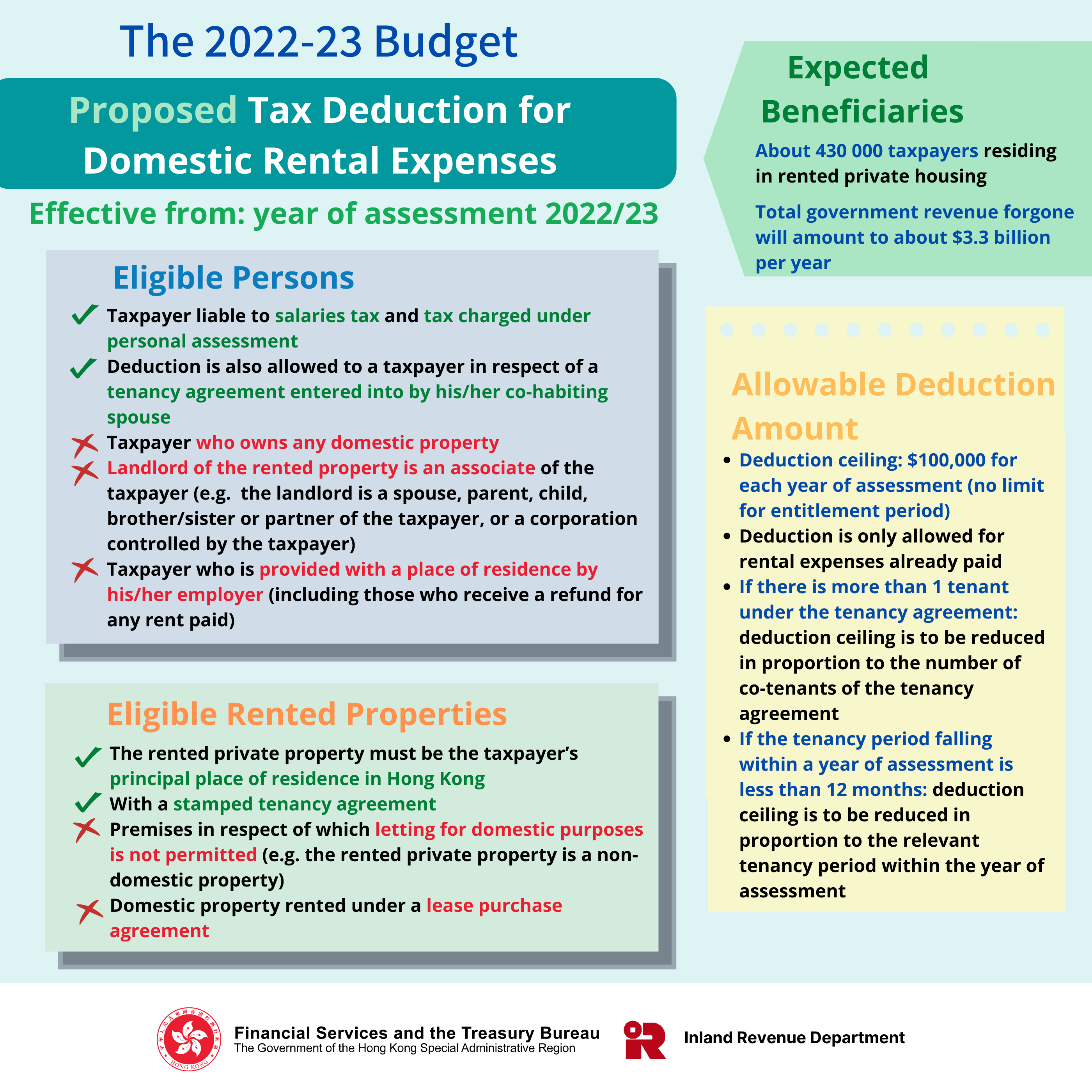

The Financial Secretary proposed to introduce a tax deduction for eligible domestic rental expenses from the year of assessment 2022/23. Taxpayers liable to salaries tax or tax charged under personal assessment who do not own any domestic property can claim deduction for the rent paid by him/her or his/her spouse as the tenant. The annual ceiling of the deduction is $100,000.

Source: Inland Revenue Department