Fashion Back in Vogue: The 2021 CENTRESTAGE Survey

The resurgence of global economic activity gave the fashion industry worldwide a bounce as early as the second half of 2020. Following the further reopening of major fashion markets in the West, the global trade in clothing is estimated to have grown by 12% and 54% in the first and second quarter of 2021, respectively [1]. Nevertheless, logistic bottlenecks and skyrocketing shipping costs will remain as obstacles on the path to normality.

Against this backdrop, HKTDC conducted a survey at CENTRESTAGE 2021, the Asian fashion industry’s premier annual event and the first fashion event staged in Hong Kong since the pandemic began. More than 290 industry practitioners were interviewed between 10 and 12 September to take the pulse of the clothing industry and discover its business outlook for the coming year. Overall, the survey revealed that industry players have high hopes of seeing fashion back in vogue as the world economy picks up and people are out and about again spending money.

The Covid-19 Shock

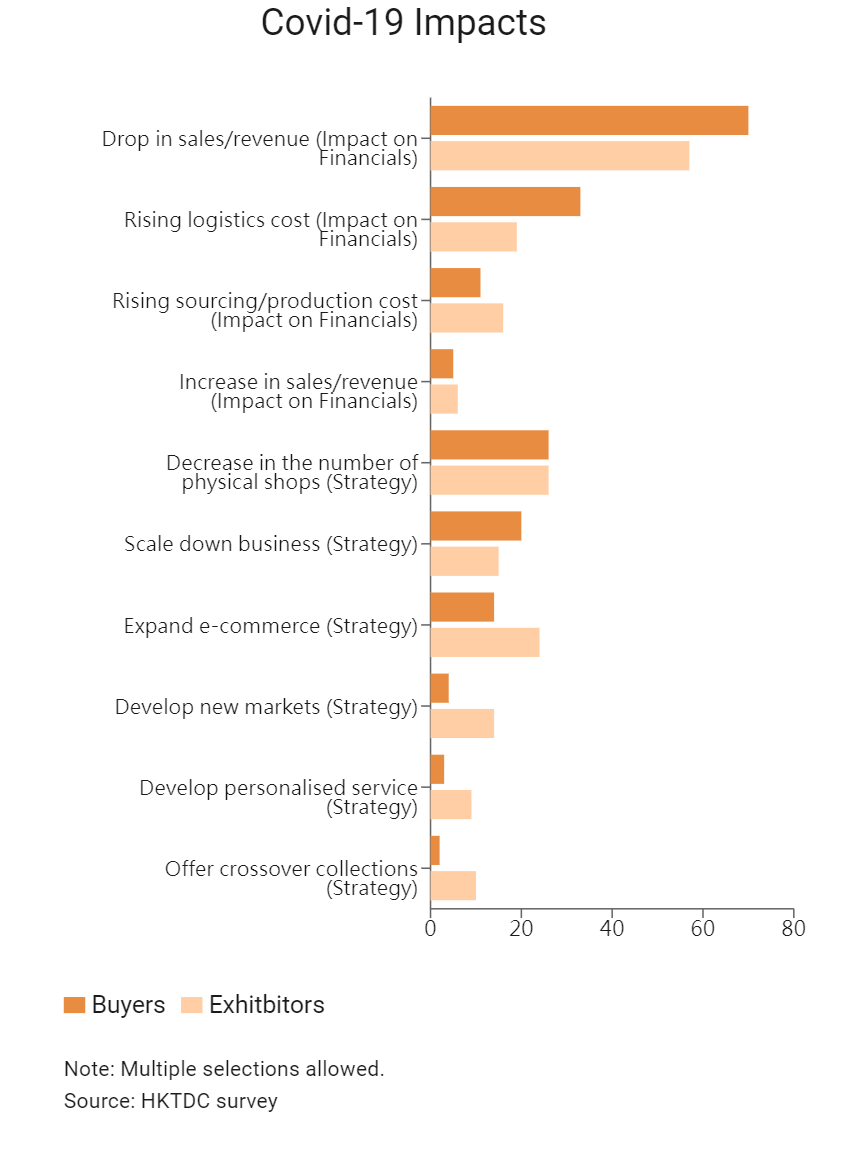

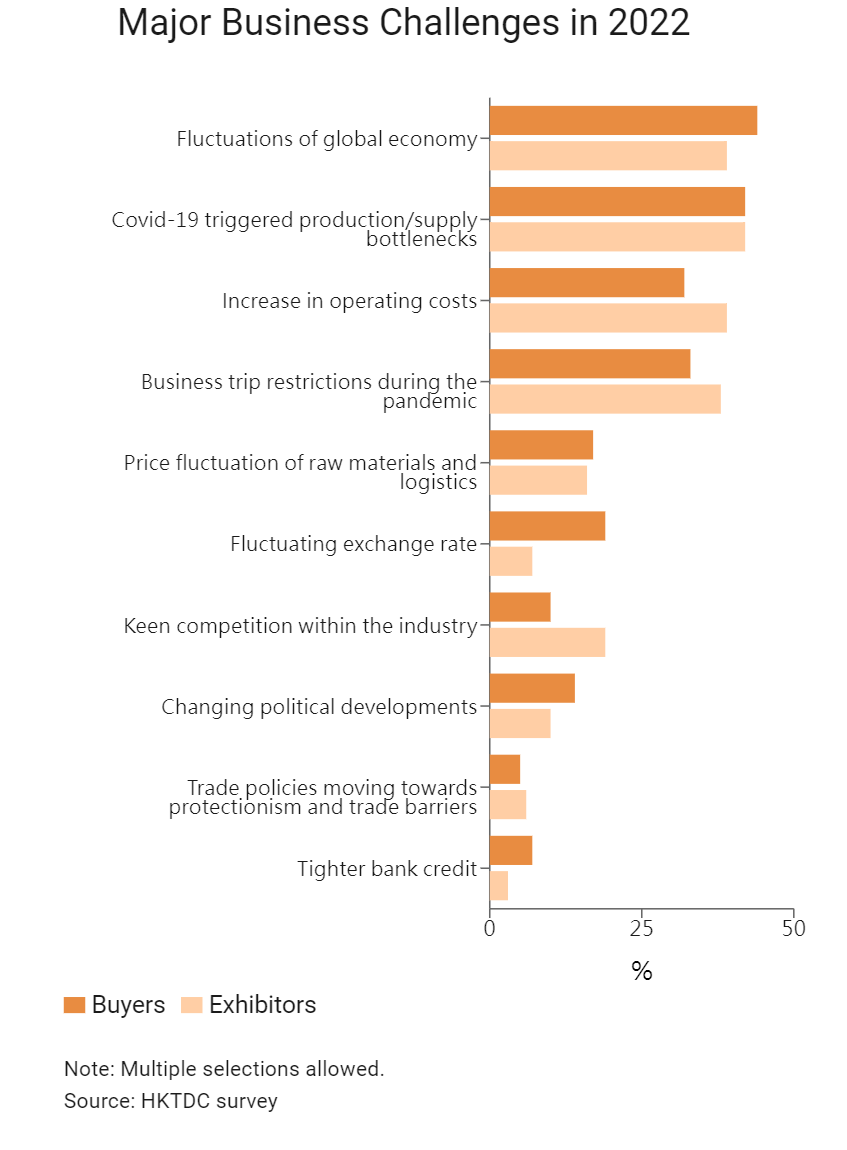

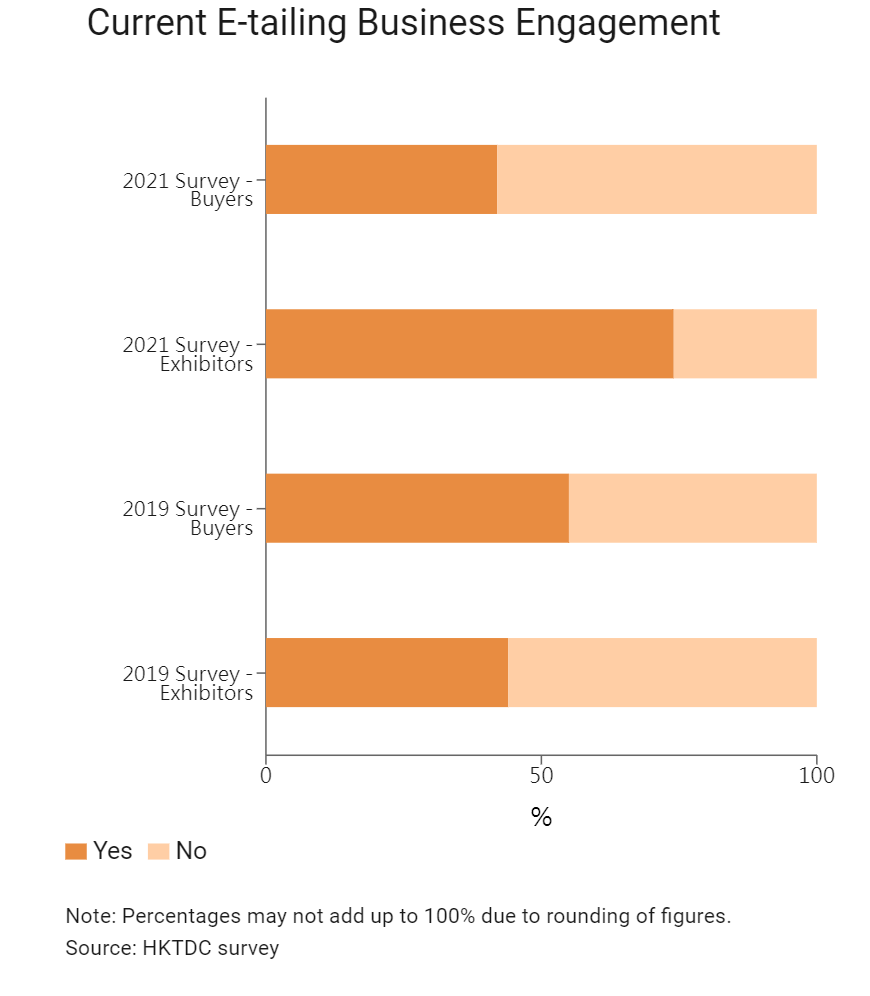

The global coronavirus pandemic has taken a heavy toll on the fashion industry, disrupting domestic and cross-border production and logistics, as well as wreaking havoc on consumer demand. According to the survey, buyers have borne the brunt of the pain. One of the major consequences of the pandemic was a plunge in sales, according to 70% of buyers, while only 57% of the exhibitors felt the same. Buyers also have greater exposure to the rising cost of logistics – the primary cost concern among traders – with one-third highlighting this pandemic-led impact on their businesses, compared to 19% of exhibitors.

The more devastating impacts on buyers’ financials are reflected in their different coping strategies. While both buyers and exhibitors have undertaken cost reduction measures such as shutting down brick-and-mortar shops (26% of buyers and exhibitors) and scaling businesses down (20% of buyers and 15% of exhibitors), buyers have been less able to increase revenue by measures such as expanding e-commerce activities (14% of buyers and 24% of exhibitors), developing new markets (4% of buyers and 14% of exhibitors), offering personalised services (3% of buyers and 9% of exhibitors) or launching crossover collections (2% of buyers and 10% of exhibitors).

|

HKTDC Export Index – by Market |

|||||

|

HKTDC Export Index by Market |

US |

EU |

Japan |

Mainland China |

ASEAN |

|

3Q21 |

44.3 |

44.1 |

47.9 |

47.8 |

44.5 |

|

2Q21 |

49.0 |

49.2 |

49.8 |

50.3 |

49.1 |

|

1Q21 |

46.1 |

42.9 |

47.3 |

48.0 |

45.2 |

|

4Q20 |

44.4 |

44.0 |

47.3 |

48.4 |

47.2 |

| Source: HKTDC Research | |||||

- 171 buyers – major markets in Europe (43%), Hong Kong (42%), North America (26%), mainland China (25%) and Asia excluding Hong Kong and mainland China (35%).

- 125 exhibitors – major markets in Hong Kong (79%), mainland China (35%), Asia excluding Hong Kong and mainland China (29%), Europe (25%) and North America (15%).

[1] Global trade rebound beats expectations but marked by regional divergences, World Trade Organization (WTO), 4 October 2021

[2] Global trade rebound beats expectations but marked by regional divergences, World Trade Organization (WTO), 4 October 2021