Reserve Bank of India: Financial inclusion grew 24% across FY17-21: RBI

The Reserve Bank of India (RBI) has said that there was a 24% improvement in financial inclusion (FI) as measured by RBI’s FI-Index between March 2017 and March 2021.

MUMBAI: The Reserve Bank of India (RBI) has said that there was a 24% improvement in financial inclusion (FI) as measured by RBI’s FI-Index between March 2017 and March 2021. The FI-Index incorporates details of banking, investments, insurance, postal as well as the pension sector in consultation with government and respective sectoral regulators. In April this year, the RBI had announced that it would launch the FI-Index to capture the extent of financial inclusion. On Tuesday, the RBI announced the first numbers of the FI-Index, and will henceforth publish the data once a year in July. The highest weightage in the index (45%) is given to the usage of various financial services, followed by access (35%) and quality (20%).

The index captures information on various aspects of financial inclusion in a single value, ranging between 0 and 100, where 0 represents complete financial exclusion and 100 indicates full financial inclusion.

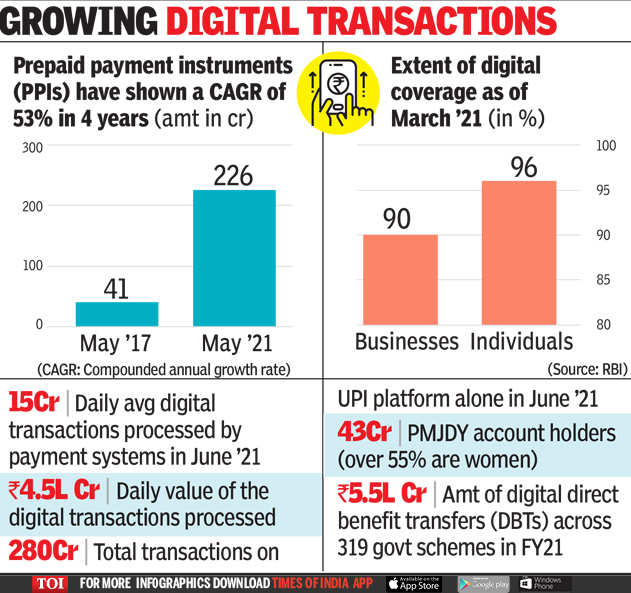

One of the biggest drivers of financial inclusion in the country has been the Pradhan Mantri Jan Dhan Yojana (PMJDY). There are about 42.6 crore PMJDY account holders with more than 55% being women. While the JDY was launched in 2014, the usage of the accounts picked up with the increase in direct benefit transfers (DBTs), which were facilitated by digital platforms and Aadhaar. The impact of the digital payment in DBT can be discerned from the fact that Rs 5.5 lakh crore was transferred digitally across 319 government schemes spread over 54 ministries during 2020-21. Since the pandemic, financial inclusion got a boost due to the increased usage of digital platform by small merchants and peer-to-peer payments. “Lessons from the past and experiences gained during the Covid pandemic clearly indicate that financial inclusion and inclusive growth reinforce financial stability,” RBI governor Shaktikanta Das had said, speaking at the financial inclusion summit. “As of March 2021, banks have achieved a digital coverage of 95.9% of individuals, while the achievement for businesses stood at 89.8%,” Das said in the summit.

The rise of the fintech’s have also supported financial inclusion as they innovated to simplify and promote digital payments like the UPI (Unified Payments Interface). According to a report by Macquarie, while the retail payments (by value) have grown at an 18% CAGR over FY15 to ’21, UPI has grown at a CAGR of around 400% over FY17-21 and now forms 10% of overall retail payments (excluding RTGS) from 2% seen couple of years ago. “Despite being a late entrant, UPI’s FY21 annual throughput value of around Rs lakh crore was almost 2.8x that of credit and debit card (at POS) combined largely,” the report said.

Source: ETBFSI from the Economic Times